ny mortgage refinance transfer taxes

New York Title Insurance. But fortunately homeowners arent required to pay the tax again once they refinance.

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

If either one does not accept the process must be.

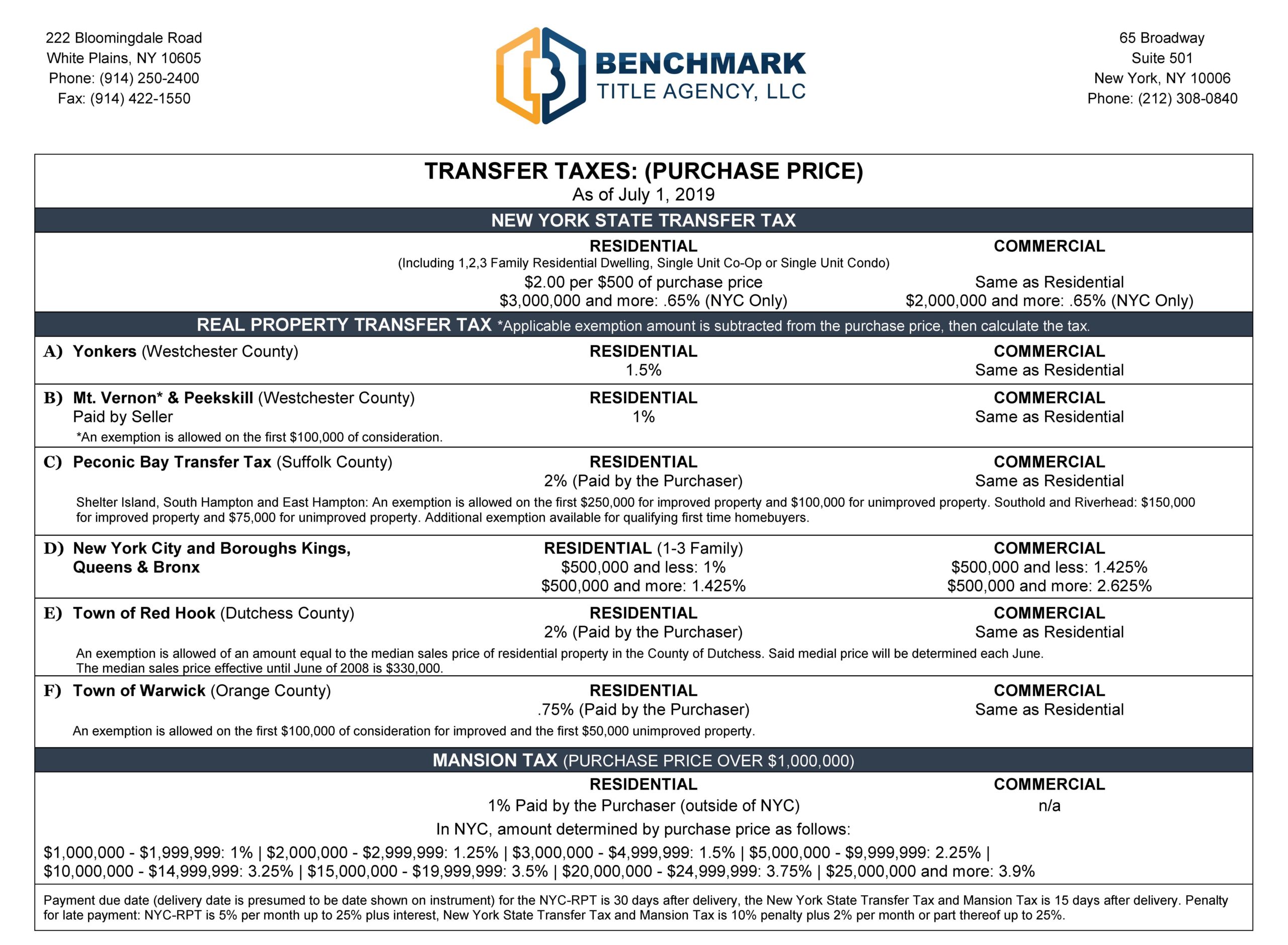

. Thats a total mortgage recording tax savings of 9625. If the value is 500000 or less the rate is 1 of the price. Residential Type 1 and 2 transfers.

Lender Doesnt Pay any of the Mortgage Tax CEMA Recorded Mortgage. New York State imposes a tax for recording a mortgage on property within the state. Thats a savings of 2000.

Do I have to pay transfer tax on a refinance in NY. These rates are what the buyer is responsible for. The tax is usually paid as part of closing costs at the sale or transfer of property.

The tax must be paid again when refinancing unless both the old lender and the new lender accept the Consolidation Extension Modification Agreement CEMA process. New York charges a NYS mortgage tax or specifically a recording tax on any new mortgage debt. Including the mansion tax.

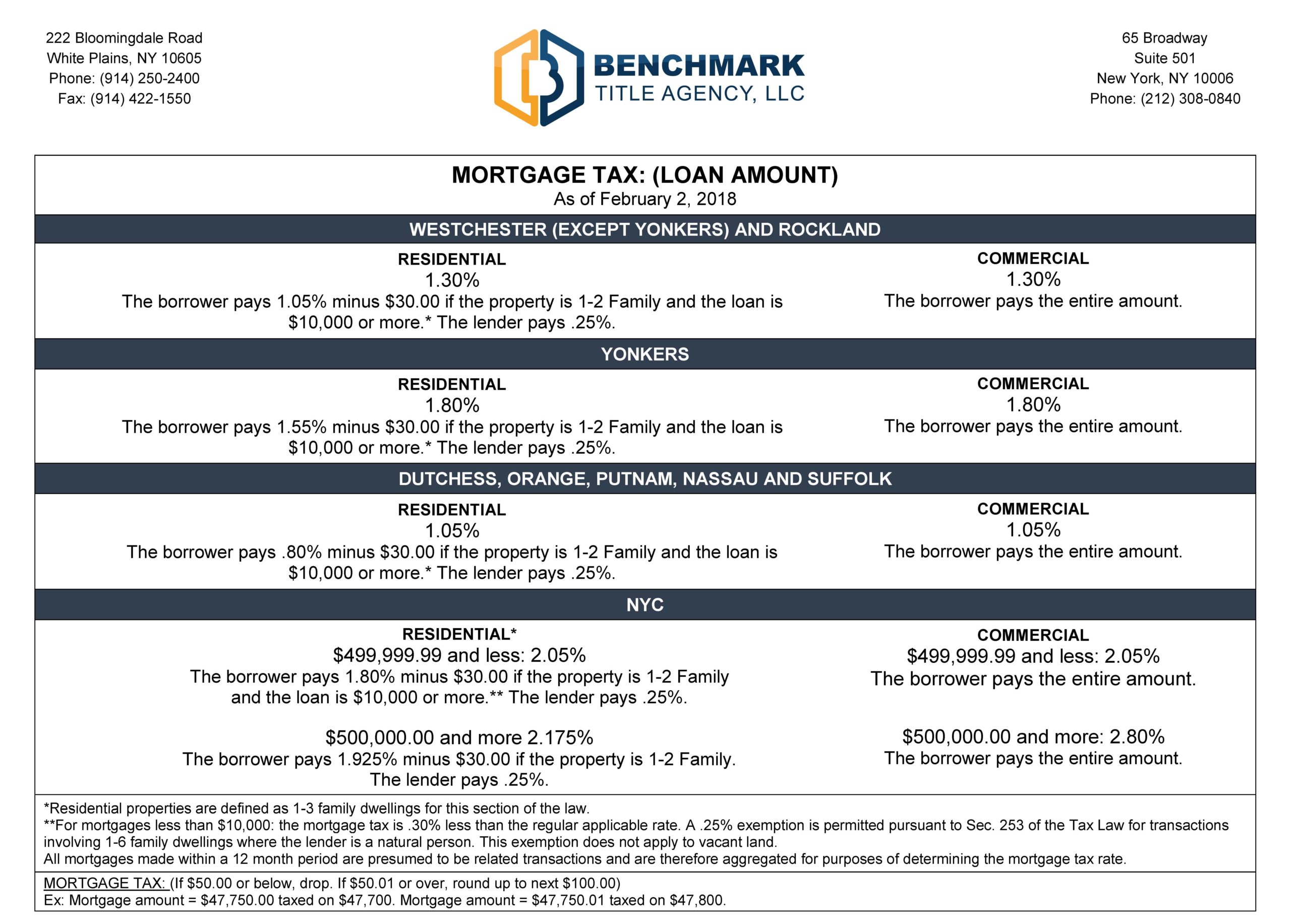

13th Sep 2010 0328 am. The lender pays 25 if the property is a 1-6 family. Additional fees Associated with a CEMA.

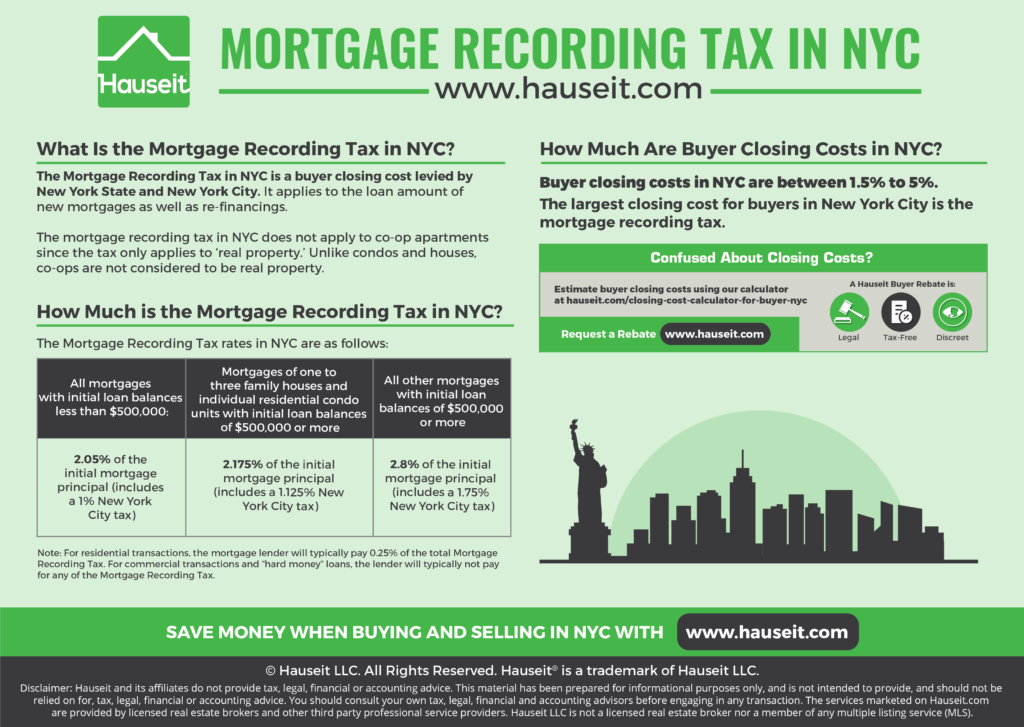

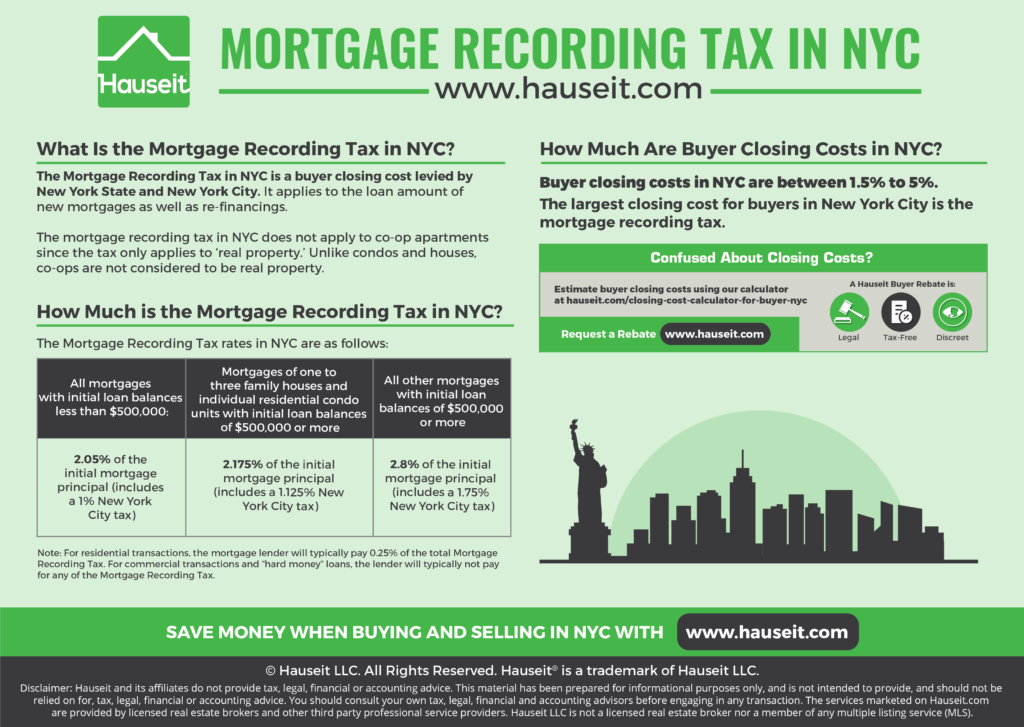

The New York state transfer tax rate is 04 for homes below 3000000 and 065 for. Basic tax of 50 cents per 100 of mortgage debt or obligation secured. The New York City Mortgage Recording Tax MRT rate is 18 for loans lower than 500000 and 1925 for loans of 500000 or more.

Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. That means the NYS transfer tax will be either 04 or 065. Thats 1528750 in savings.

Along with the state tax New York City Yonkers and several counties apply an additional local tax on recording a mortgage. New York homeowners looking to refinance an existing mortgage dont have to pay the states mortgage recording tax all over again. Transfer taxes are applied to a change of ownership for any type of property that requires a title as stipulated by a deed or other legal document according to.

If youre refinancing in New York you could avoid paying mortgage recording tax and save yourself a chunk of money. The tax rate and amount of tax due depends on the type of sale or transfer of property. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes.

Rather than the Seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the mortgage obtained by Buyer. May 23 2013. In many cases however a homeowner may be able to avoid the mortgage recording tax on a refinance if the original lender and the new lender cooperate.

The total buyer mortgage tax with a CEMA is only 1925. Special additional tax of 25 cents per 100 of mortgage debt or obligation secured. New York City Property Original Mortgage.

This rate varies by county with the minimum being 105 percent of the loan amount. It might also be added that apparently there is a transfer tax if you refinance and go from a title in a persons name to a title in that persons TRUST. For mortgages less than 10000 the mortgage tax is 30 less than the regular applicable rate.

Your mortgage lender will also contribute 025. 18th May 2010 0533 am. Lets break down the numbers.

The total buyer mortgage recording tax without a CEMA is 11550. In a refinance transaction where property is not transferred between two parties no deedtransfer taxes are due. In NYC the buyer pays a mortgage recording tax rate of 18 if the loan is less than 500000 and 1925 if more than 500000 or more.

Additionally in 2019 NYS imposed an additional 025 transfer tax on all properties above 3 million. 700000 Refinance Loan Amount. Title insurance rates are regulated by the State of New York therefore title insurance rates will be the same between title insurers.

The recording of a mortgage is subject to. Buyers of commercial property pay 255. An additional tax of 25 cents per 100 of the mortgage debt or obligation secured 30 cents per 100 for counties within the Metropolitan Commuter Transportation District.

The New York State transfer tax rate is currently 04 of the sales price of a home. When combined with the NYC Real Property Transfer Tax buyers can expect to pay a total New York transfer tax of between 14. New York NY and NYC Transfer Tax.

The recording tax applies to both purchases and refinances but excludes co-ops. Generally the seller will pay for the transfer tax in New York but if the seller is exempt then the responsibility to pay this tax falls upon the buyer. New York State also applies a 04 transfer tax on all properties.

Our guide to the NYC MRT will help you better understand this closing cost including who pays it how to calculate it and how to avoid or lower your overall mortgage tax liability. The Seller NYS transfer tax without a CEMA loan would be 3000. Yes the CEMA process allows you to only pay the mortgage tax on the new money.

It typically is about 12 of your loan amount which can significantly increase your closing costs. Therefore the effective Mortgage Recording Tax rates you pay as a buyer in NYC are 18 for loans under 500k and 1925 for loans of 500k or more. The Seller NYS Transfer Tax with a CEMA would be only 1000.

In NYC this tax ranges from 18 1925 of the mortgage. 750000 X 2175 1631250. The Mortgage Recording Tax Rates in NYC are technically 205 for loan sizes below 500k and 2175 for loan sizes of 500k or more but the buyers lender typically pays 025 of the MRT.

The borrower pays 80 minus 3000 if the property is 1-2 family and the loan is 10000 or more. On a refinance of a 385000 mortgage on a single-family home in Brooklyn the mortgage recording tax would be 6900 for the homeowner and 96250 for the new lender Mr. 50000 x 205 1025 Recorded Mortgage on Full Refinanced Amount.

The NY mortgage recording tax. Yet they may end up doing so if their lenders. If the value is more than 500000 the rate is 1425.

Do you have to pay NYS mortgage tax on a refinance.

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Closing Costs Of Selling A Home In Colonie Ny Closing Costs Selling House Things To Sell

Refinancing Flyer Template Instagram Support Services Real Estate Flyers Appraisal

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Reducing Refinancing Expenses The New York Times

A New Tax For New York S Commercial Real Estate Industry Commercial Real Estate Business Tax Real Estate Tips

Transfer Tax Reform Behind Nyc Luxury Apartment Sales Slump Nyc Apartment Luxury Luxury Sale Mansions